Insurers that resist change and continue to rely on their old policy branch systems are missing out on the incredible advantages offered by the new-age SaaS-based PAS, which offers incredible benefits and improved usability, accessibility and configurability. This article addresses these aspects and lists the advantages that a PAS offers to improve an insurer’s competitive edge. All PAS systems do not offer such advantages and some actually fail to replace the legacy system, wasting an insurer’s time and assets and setting them back. Therefore, it is important for an insurer to be properly informed and aware of the capabilities of a PAS and the benefits offered by its admission.

Insurers that remain dedicated to their worn-out Policy Delivery Systems do not realize that their devotion is affecting their competitiveness in the marketplace by halting their services and restricting their ability to introduce new products to the market.

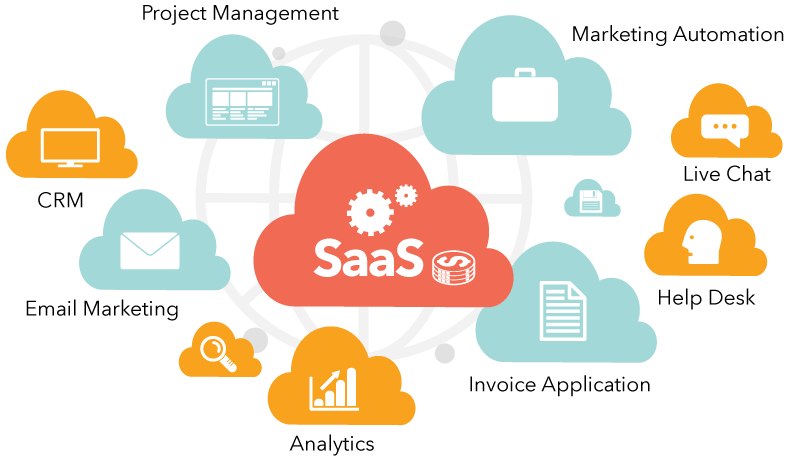

One way to reverse this ongoing, premature disruption is to adopt a SaaS-based portal that will be your new policy branch system. Enjoy its support across the entire value chain, from product growth to benefits underwriting, and manage insurance products with unsurpassed agility. This is possible with a SaaS-based product rightly designed for ease of use, accessibility and configurability. Let’s explore each of these advantages in detail, so you have clarity on how to build that business case to suggest immediate admission:

Usability:

1. The software offers environment modules, which can be concluded independently or together, which offers unlimited flexibility and cost economy for a fussy favored.

2. Offers flexibility in customization and implementation, and supports multiple clients, currencies and languages.

Its modules are extremely intuitive to use since no coding is required.

4. Allows you to govern all types of insurance products, such as P&C, Utility, Life, Life, Vigor, Prepared, Backup, Pension, Annuity, etc. without having to code null; saving significantly on time and costs.

Accessibility:

1. Suitable and hosted as a web application or can be hosted on the cloud.

2. The agent portal is integrated into the policy branch system to provide support to agents and direct clients.

3. Allows loading and importing data from Excel files

4. Makes integration with third parties and underwriting processes cascading and flexible.

5. No programming is required to attach forms and print data on forms.

6. Generate policy data as tokens and print policy data in positive time on forms.

7. Easily load rule-based forms.

8. Maintains a repository of basic forms, coverage forms, ACORD forms, paste forms for various product lines and keeps them separately in different file sub-networks to simplify communication.

9. Can integrate with multiple policy processing systems primarily through API or XML.

10. Organize forms according to the type of form.

11. Allows the configuration of forms for printing policy data according to existing (client’s) templates.

12. Generate placeholders or tokens to be placed on forms for policy data at the time of form generation/printing.

13. Attach forms according to the sequence defined by the favored party.

Configurability:

1. It is a hypermarket product, which uses a role-based configuration and unified workflows that users can configure according to their unique business deyection.

2. Issues and stores all policy data and documentation according to the product mannequin and allows changes and modifications to be completed in a matter of hours, rather than days.

3. Product version control allows a single product to be provisioned using state, agency and customer specific screens, with workflows defined by the favored role.

4. Business users can easily configure changes, without the intervention of database administrators.

5. Users can build new products from scratch easily and without much effort or loss of time.

6. Users can determine Carriers, Agents, Brokers, Distributors and their immediate commercial information with the mapping of their producers and products.

7. Supports all policy transactions from Quick Quote, Policy Draft and Binding, Account Creation, Quotes, Policy Supply, Endorsements, Renewals, Cancellations, Reinstatements and Rewrites.

8. Unified policy states and next actions allow customers to configure workflows according to their dejection and remove policy states that do not match their business dejection. Automated out-of-sequence backup comes as an additional feature.

9. Its scoring module allows the maintenance of multiple scoring tables without duplication, providing faster response and better timely performance to the execution of rule-based scoring steps, increasing the hit rate and ensuring better performance.

10. Integration with the built-in underwriting module, rating module and forms module provides quick responses from each support module and completes the quote/policy transaction in no time.

11. Its underwriting module integrates with multiple systems, allowing business rules, regulatory rules and favored-specific rules to be configured in a single location and making them easy to maintain. It supports searching existing rules, decision tables and dashboards, and defines allocation rules and sets due dates.

12. Its reporting module allows users to spread reports manually and also trigger reports by defining the frequency of reports automatically. It also offers many unified reports and allows users to configure customized reports.

13. Offers role-based dashboards for carriers, agencies, brokers and other distributors.

14. It also provides flexibility to integrate with any foreign system.

15. Supports manual and automated policy processing.

Visualizing the time, room and asset benefits of adopting such a system should be quite daunting after this detailed explanation. Talk to us to set up a demonstration of these capabilities and benefits to understand how they can help you improve your business processes and flexibility. That would help you take an informed boldness and avoid enriching an exorbitant price for an ineffective product intended to replace your legacy system, but which offers no return on investment and may even affect your business continuity.